European open source software (OSS) is hot right now. On the one hand, we see increasing adoption of OSS by European enterprises, and on the other hand, there have been numerous venture capital investments in European OSS startups over the last years. In order to get a better understanding of the European OSS startup ecosystem, this article summarizes some research (from platforms such as GitHub, Crunchbase or Pitchbook) and gives an overview of the current players. But before we dive into the startup list, let's take a look at some hard facts about the European OSS startups ecosystem:

- 3 million developers are living and coding in Europe, making it a larger community of open source developers than those in the US [Octoverse]

- 424 open source software related companies are headquartered in Europe [Crunchbase]

- 22 funding rounds with a volume of approx. €100 million have gone to European OSS startups in 2020 [Crunchbase]

- 21 European OSS startups have been acquired in the last 5 years [Crunchbase]

In the last decade, European tech has experienced a renaissance and visibly caught up with the American and Chinese ecosystems (the gap is still there, of course). This trend has also taken place in the open source space and it was even particularly strong here. This is because Europe is made for open source (for the following reasons):

- Lower costs: The average software developer in Germany costs 27,5% less than his colleague in Silicon Valley [3]. And Germany is one of the most expensive countries in Europe. The difference becomes even greater when you look at countries like Poland or Portugal.

- Global adoption: The European market is considered to be fragmented which is often seen as a limitation for local commercialization activities. In the open source world, companies build products for a global audience from day one, relying primarily on community adoption rather than a large sales team and geographic go-to-market strategy.

- Untapped potential: Europe is home to many tier-1 tech universities and a healthy network of existing tech players. Nevertheless, Europe has long remained below its great potential. This may change with the potentially upcoming open-source boom.

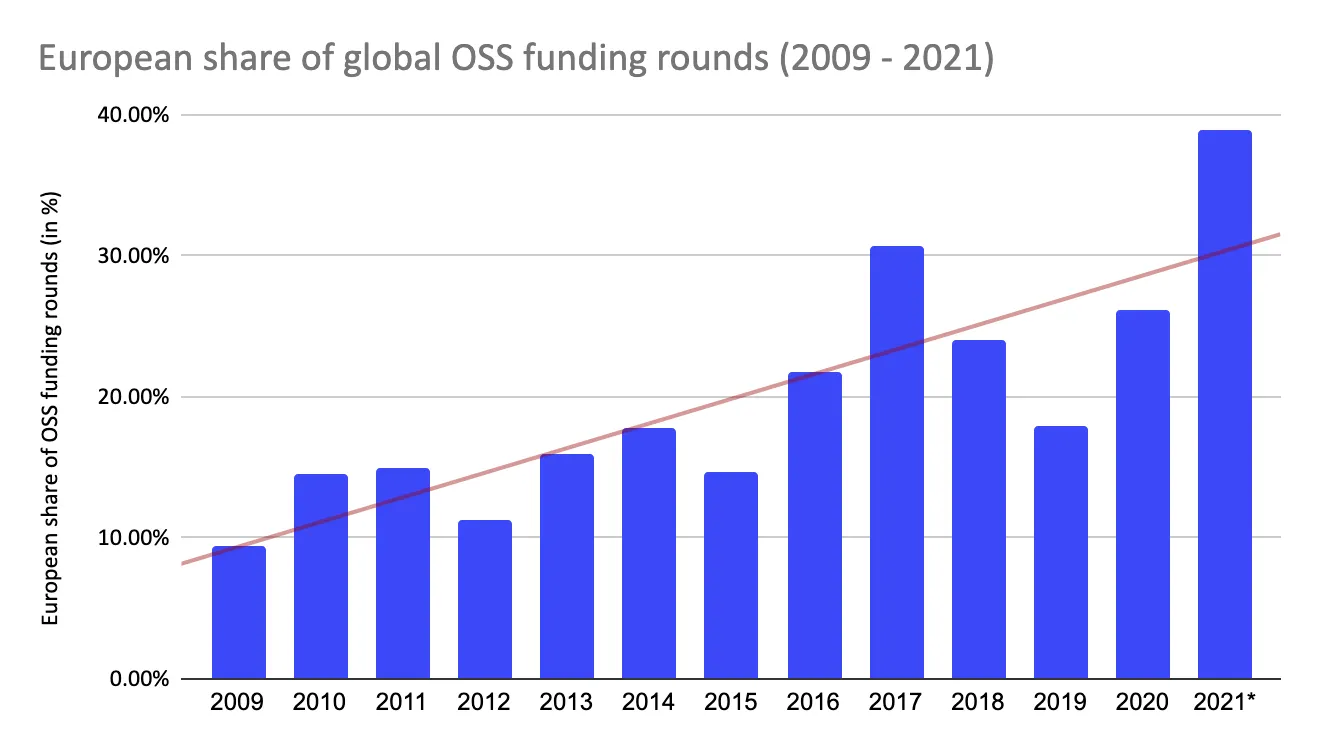

If these arguments haven't convinced you, let's take a look at venture capital investments: Since 2009, the share of OSS funding rounds (quantity not volume!) that have gone to companies headquartered in Europe has risen from 9% to 38%. This is equivalent to a (relative) quadrupling within a decade!

Data source: Crunchbase, measured at the end of Q1 2021

So it's time to take a closer look at this thriving ecosystem and in particular its commercial startups. To give an introduction, I put together a selected list of open source companies --- ranging from small startups to grown-up unicorns. I sorted the companies into the three categories "unicorns", "rising stars" and "new kids on the open-source block". The categories are certainly self-explanatory, but are nevertheless explained in a short introduction section.

In this context, I considered the following to be "open source":

- Companies, who primarily build their products and business model (e.g. open-core) around OSS projects

- Companies, who spend significant effort on maintaining and contributing to open-source projects

Not included in this list are:

- Service and consulting companies

- Big tech companies that have OSS projects, but are known primarily for other reasons (e.g., HERE Technologies)

Everything clear? Then let's jump in...

The Unicorns

Believe it or not, there exist four European open source companies that have surpassed the magical $1 billion valuation, making them unicorns. Of course, this figure is not outstanding --- especially when you consider that 2 out of 4 unicorns were founded more than 20 years ago. But it gives at least an idea of how successful European open source companies can be. Let's take a look at the European champions:

SUSE

This one is a true open source pioneer: SUSE was founded in 1992 in Germany and has since then been an exemplary story for successful open source commercialization. The company offered the world's first enterprise Linux distribution and was thus able to achieve a valuation of €2.3 billion. In 2018 the company was acquired by the well-known private equity fund EQT. Their plan is to take the company public in May 2021.

JetBrains

Over 10 million developers are using JetBrain's products, which include IDEs, project management tools and even a programming language. The Czech company achieved its remarkable €6.4 billion valuation entirely without the support of venture capital. JetBrains maintains numerous open source projects, including Kotlin and a community edition of intelliJ, and contributes actively to the open source community.

Snyk

Snyk enables 2.2 million developers to build secure applications with its developer-first cloud native AppSec approach. Launched in 2015, the company already raised €684 million, including a recent €300 million series E, and achieved a €4.3 billion valuation. The company was funded and is headquartered in London. Snyk's dependency scanner makes it easy to find, prioritize and fix vulnerabilities and license violations in open source dependencies and container images. The startup has grown largely through open source and still offers all products in a free version.

Adjust

Adjust develops analytics and fraud prevention software for mobile applications. The company's open-source portfolio includes a range of mobile SDK's. The Berlin-based startup raised over €233 million in venture capital and was acquired by U.S. competitor AppLovin in February 2021 at a valuation of €1 billion. So when you get right down to it, this company is no longer a European player (due to the short time gap I have listed them anyway).

The Rising Stars

It is very likely that more companies will join the club of European OSS unicorns in the upcoming years. A new generation of open source based startups has emerged in the last decade and is gaining more and more traction. "Rising Stars" are companies that are not older than 10 years and have reached a valuation of more than €200 million. According to my research, there are currently two of them in Europe:

Akeneo

Akeneo is a leading vendor for product experience management software that helps merchants and brands deliver a strong customer experience across all channels. The startup was founded 2013 in France and has since raised €56 million in venture capital. In addition to its enterprise products, the company still maintains a community edition on GitHub and reveals large parts of the source code. According to company statements, Akeneo strongly believes in the value of open source technology and sees thereby benefits for both code quality and flexibility.

Aiven

Aiven offers companies fully-managed open source data infrastructures --- e.g. for Apache Kafka, PostgreSQL or Elasticsearch. Over 140 employees work at the startup, which was founded in Finland in 2016. Just recently, the company completed a €100 million series C involving investors such as Atomico, Earlybird and Salesforce Ventures. With an estimated valuation of €364--545 million [4], the startup is on the best way to joining the European OSS unicorn club.

The New Kids on the Open Source Block

Open source companies that have been founded in the last 3 years (2018 and later) and already gained notable traction (be it through Github stars, funding, PR, ...) are referred to as the "new kids on the open source block" in this article. There are well over 20 of those in Europe. Below you can find a small selection:

n8n

Founded in 2019, N8n develops a free and open-source workflow automation tool and appears to be a viable alternative to industry leaders such as Zapier. The Berlin-based company has raised a seed round of €1.4 million from prominent investors such as Sequoia, Firstminute Capital and Runa Capital, as well as several business angels. N8n's GitHub repository is currently (April 2021) starred by over 13k developers.

TerminusDB

TerminusDB was founded in 2018 and offers an open-source knowledge graph database that provides privacy-enhanced revision control and collaboration. TerminusDB's Github repo gained notable traction (over 1.300 stars) within the first year. The Dublin-based startup recently raised a €3.6 million Seed round --- bringing its total funding to €4.6 million. The funding will be used to grow the commercial offerings of the startup. It will be interesting to see how TerminusDB will establish itself in the data architecture space.

Gitpod

Gitpod offers ready-to-code development environments for the cloud-native age. The open-source company is officially founded and headquartered in Northern Germany, but maintains a remote-first culture. According to the company's website, over 300,000 developers are already using Gitpod's platform. Just recently, General Catalyst and Co. invested €10.9 million in Gitpod. This certainly makes it one of the most promising European OSS players.

Edgeless Systems

Confidential computing is one of the hottest topics in cloud security. Bochum-based Edgeless Systems has the mission to build the developer tool stack for cloud-native confidential computing and is the first company in this space completely dedicated to open-source. The team around Ex-Microsoft researcher Felix Schuster recently organized the "Open Confidential Computing Conference" with over 700 developers from around the world.

Saleor Commerce

The Polish startup Saleor Commerce develops a headless, GraphQL-first e-commerce tool, which is considered to be the world's fastest growing open-source ecommerce platform with billions of dollars transacted. The company has just received €2.1 million in seed capital from Cherry Ventures and some well-known business angels such as Guillermo Rauch (founder of Vercel).

This blog post was first published on Medium in April 2021. The list is not exhaustive and should be considered as a working document.